Refinancing for Separation or Divorce

Going through a separation is difficult for everyone. We can make it a bit easier by helping you access the equity in your home in order to buyout the other partner so one person can stay in the home and the other can move on to a new place. This provide some stability for the family and allows everyone to move forward.

Purchase + Improvements Mortgages

Get the renovations you want on your new home, the moment you take possesison, and finance them at the same low interest rate as your mortgage!

Supporting Buyers in 2021

The best way to support your buyers is going to be through education and reassurance. Fear is a killer of deals, so we need to make sure our clients are comfortable every step of the way and paint a bright image of the future.

The big picture message for 2021 is… don’t panic! While the world is certainly in a different place, we are still able to do business as usual; just differently. Our digital solutions for home buying have never been more robust. We can complete our entire application and approval process via teleconferencing, DocuSign, phone calls, email, and secure document exchange. Realtors are doing virtual tours and document signing, and we have partnered with lawyers that will even allow clients to sign documents remotely via zoom so they can skip the boardroom entirely.

The best advice for buyers is to get pre-approved early in the process, and that it never hurts to have a second opinion. The sooner we can get involved with a pre-approval, the sooner we can get ahead of any issues we might have around credit scores, income, debt-servicing, and down payment verification. You just never know what you’re going to run into these days!! From extra scrutiny for people with jobs in industries most affected by the pandemic, to people saving for their down payment in Bitcoin, 2020 has come with a whole host of new challenges to be conquered.

A piece of good news… Rates! They’ve never been lower. We are currently doing pre-approvals to lock in rates as low as 1.74% for 120 days to give buyers a safety net in case rates start to go the other way. Keep in mind pre-approval rates are higher than the rates we issue on live deals. I think the lowest one I’ve seen so far is 1.54% for a 5-year fixed term.

All the rate-war madness means lenders are busier than ever, especially for January, and that is unfortunately impacting turn-around times. The best thing to do before making an offer is to make sure we have all the client’s documents on file ahead of time so we can review them and inspect them for any deficiencies. That way we can still go from written offer to lifting a condition of financing in one week without having to ask for an extension. With the market being as tight as it is, extensions are just not a good idea if they can be avoided. We expect the spring of 2021 will bring even more competing offers.

In summary, our motto is the same as the Scouts: “Be prepared!”

Get pre-approved early in the process

Consider options like the First Time Home Buyer’s Incentive and RRSP Withdrawal

Lock in a pre-approved rate as a safety net in case rates start to rise

Check in with your broker often and let them know immediately if anything on the application has changed

Provide supporting documents to your broker ahead of making an offer

Present a clear picture of where the down payment is coming from so there are no surprises

Contactless Purchase Options

Advanced Mortgage has partnered with law firms to offer a fully contactless mortgage solution. We’ll collect your documents via secure upload and your final signing appointment can be facilitated via video call.

Down Payment

HOW TO VERIFY THE SOURCE OF YOUR FUNDS Buying a house? If you don’t buy property regularly—and most people don’t—you may need a refresher on the rules for mortgages and down payment sources. Not only will you need to prove that you can afford the mortgage, you’ll also...

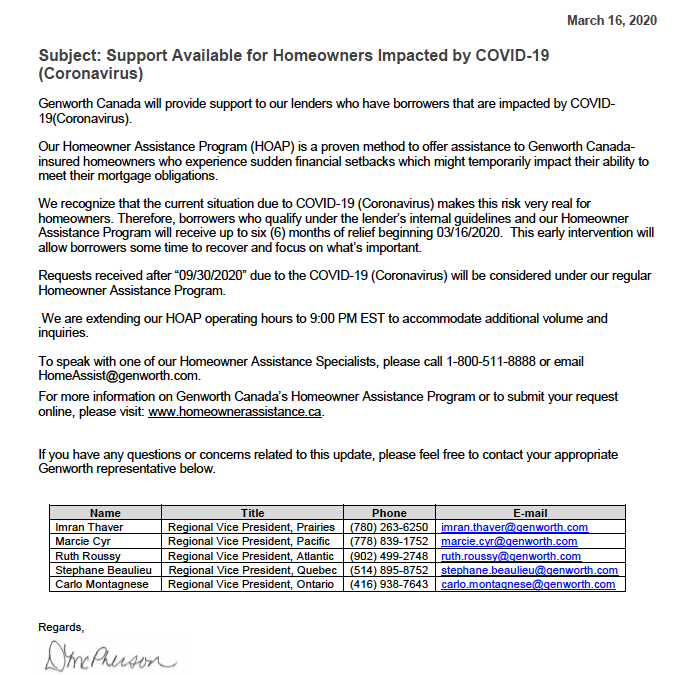

Relief has arrived for homeowners affected by the Covid-19 (corona virus) pandemic

Download PDF

Lower interest rates send mortgage market into a frenzy as buyers race to take advantage

To Buy or to Wait

.PDF Download

What is the First Time Home Buyer’s Incentive?

As of September 1, 2019, Canadians have access to a new program that makes it easier and more affordable to become a home owner. The Government of Canada is offering 5% for qualified home buyers of existing homes and up to 10% for new construction homes. The basics of...

Going Through a Divorce? Learn About Our Spousal Buyout Program

With the divorce rates in Canada trending around 50% in 2018, understanding your rights during a divorce is critical for nearly half of the married couples in Canada. Knowing your rights could not only protect your financially, but it could also save your children...