First-Time Home Buyers’ GST Rebate on New Homes up to $1.5 Million

As part of the federal government’s attempts to make living and owning a home in Canada for younger Canadians (and any qualifying “first-time” home buyers) more affordable, Canada has introduced a new rebate to refund/offset of up to $50,000 of the GST on the...

How to Help Your Kids Buy a Home

How to Help Your Kids Buy a Home: Gifting vs. Co-signing Buying a home is a significant milestone for anyone, and with affordability becoming a bigger challenge every day, many parents want to help their kids get into their first home. There are two common ways...

Different Kinds of Debt and How They Affect Your Mortgage Approval

Different Kinds of Debt and How They Affect Your Mortgage Approval When applying for a mortgage, lenders calculate what they call a “debt-servicing ratio” by looking at your monthly payments and dividing it by your monthly income. So for example if you make $100 a...

Unveiling the Cost Savings of an Energy Efficient Home

Going Green - Unveiling the Cost Savings of an Energy Efficient Home Save money today, save the world tomorrow. Ranked 15th on the Green Future Index globally in 2002, and 2nd best out of the worlds top 15 oil exporting countries, Canada is a global leader in ESG...

How Can I Improve My Credit Score?

How Can I Improve My Credit Score? Mortgage lenders will use your credit score to help them decide whether to approve you for the home you want. The better the score, the greater the chance you’ll get the mortgage you’re looking for, and potentially at a lower...

Navigating the Canadian Real Estate Market – Why Now is the Right Time to Buy

In the constantly changing landscape of the Canadian Real Estate market, potential homebuyers often find themselves pondering the question, “Is now a good time to buy or should we rent/save for another year? “ With over 25 years in the mortgage industry, I'm here to...

Removing an Ex Spouse From Your Mortgage

Step by Step Guide to Help You Through Separation Dissolving a marriage or partnership is one of the most difficult things people face in their lives. We hope the below step-by-step guide will help make the process as easy and stress free as possible. Talk to us –...

Winning the Mortgage Renewal Battle Will Save You Thousands

One of the most overlooked and expensive mistakes made in personal finance is overlooking your mortgage renewal. For many Canadians, the mortgage renewal process is often seen as a routine task, simply rolling over the existing mortgage with the same lender. However, taking the time to explore your options and shop around can be a game-changer, potentially saving you thousands of dollars. In this post, we will better explain the importance of looking beyond your current mortgage provider when renewing your mortgage.

Three Common Scenarios – And What To Do About Them

The real-estate and finance markets in Canada are tumultuous to say the least. With rates at decade highs, and media outlets spewing fear, it’s important not to get caught up in the emotion of it all. Let’s step back and look at three situations...

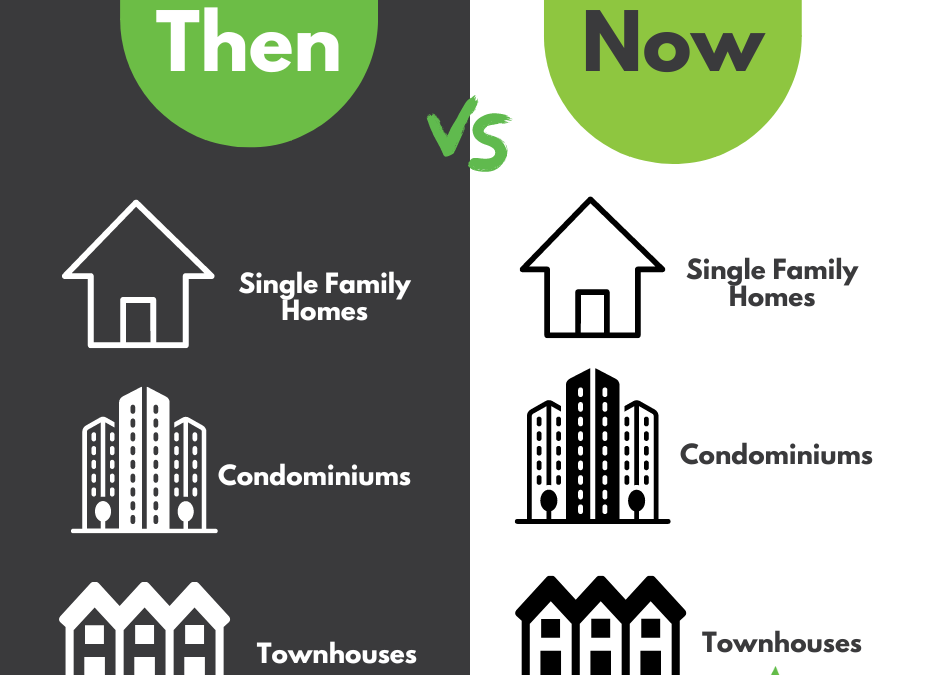

Then vs. Now

Are you thinking of buying your first home, moving up, or looking at that vacation home but aren’t sure if you should get into the market now or wait? It’s no secret that the cost of living keeps going up. Not only are prices for all goods increasing steadily,...